Initial Balance Indicator

What is Initial Balance?

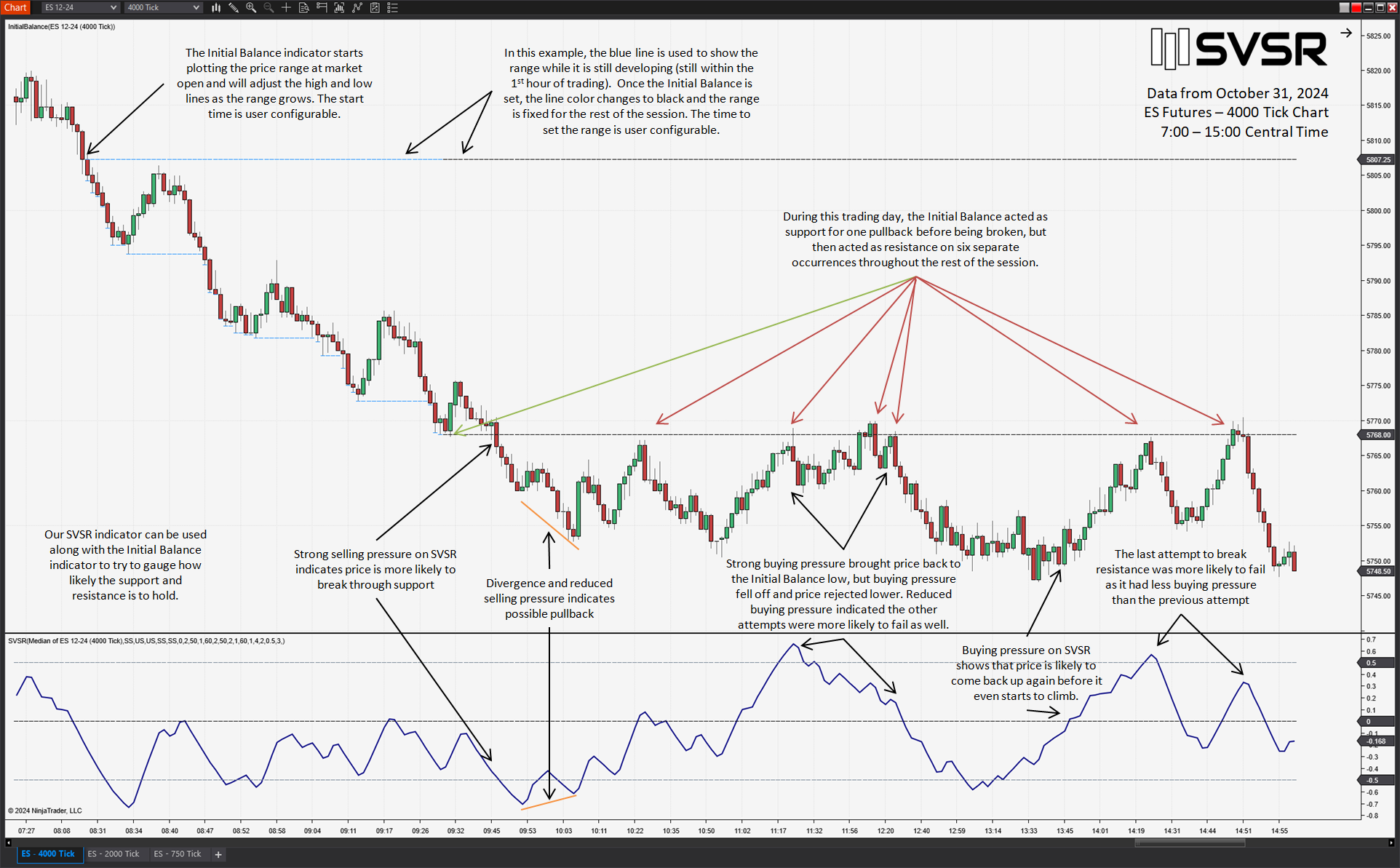

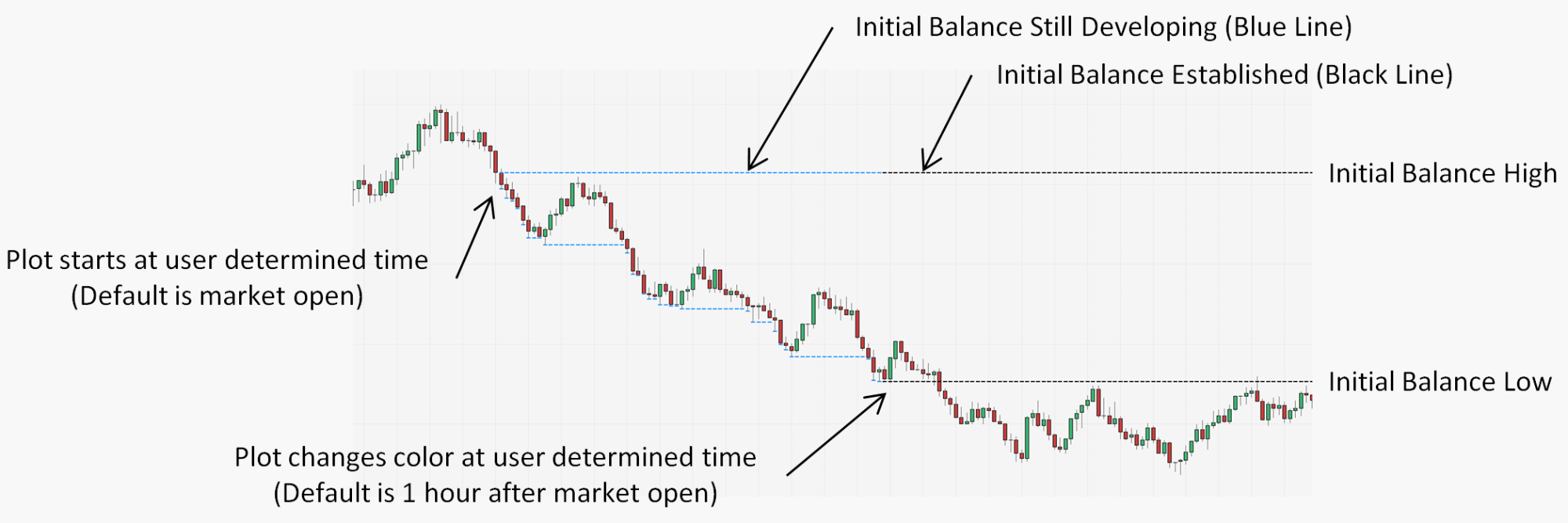

Initial Balance identifies the price range during a period of time after market open (sometimes referred to as Opening Range). Most often traders use this tool to evaluate the first hour of trading after market open, but using other time periods is possible. The high and low levels of the Initial Balance will often become levels of support or resistance throughout the day.

Other similar indicators on the market tend to just provide the high and low values, however, our version of Initial Balance is designed to quickly show you at a glance how the price range developed. It also provides points of reference for market open and when the Initial Balance is established.

That's all great, but how is it used?

Having our version Initial Balance indicator on your chart provides a couple of benefits:

- It shows areas of possible Support and Resistance without having to manually find them.

- Gives a quick frame of reference for how the price range developed.

- Clearly shows if the range is still developing or is now established.

- Works well when paired with our SVSR indicator to determine where price is likely to bounce or resume trend.

The following is an example of how these would look on a tick based chart, but any other chart type works as well.

More Detail on the Initial Balance Plot

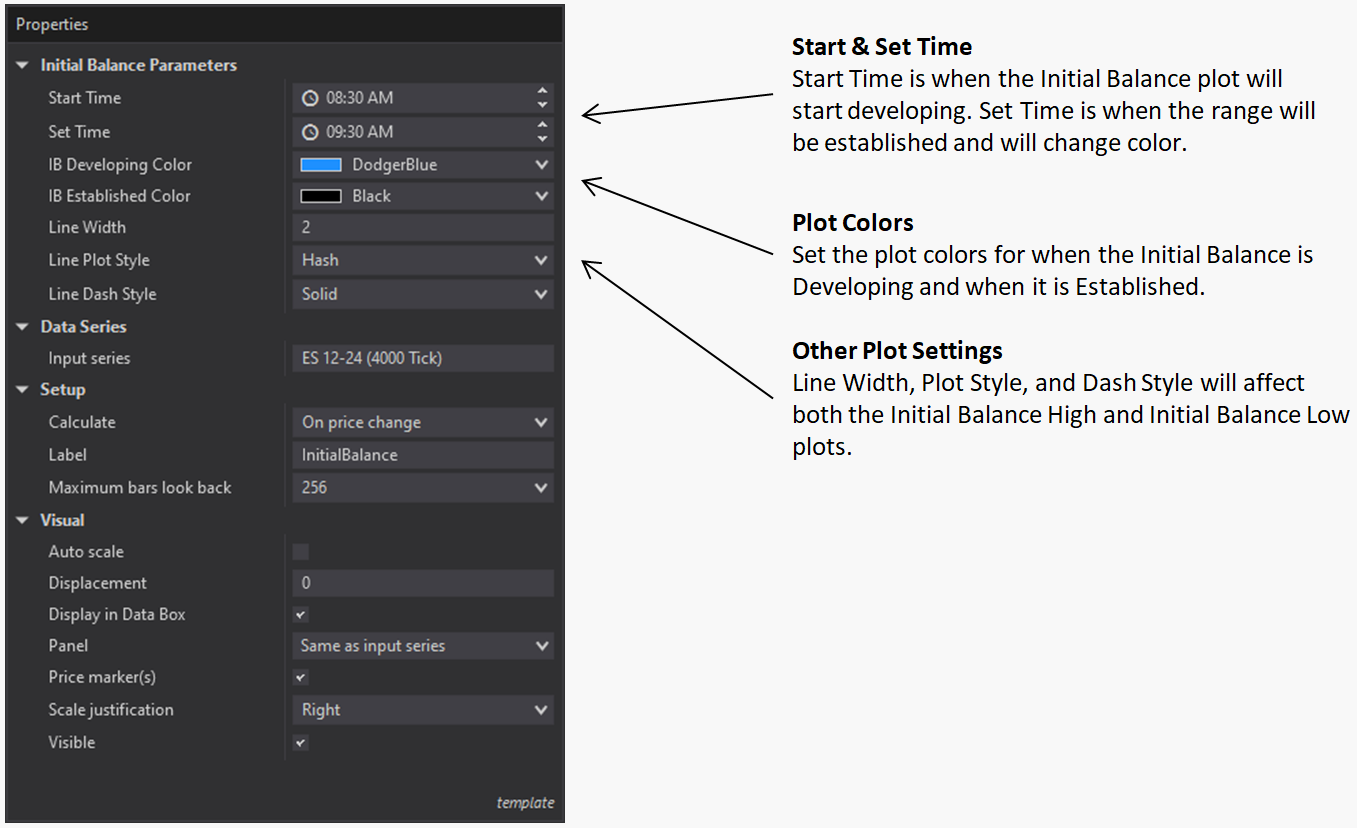

Breakdown of the Initial Balance Settings

Futures, foreign currency, and options trading contains substantial risk and is not for every investor. An investor could potentially lose all, or more, than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.